In the vibrant landscape of India’s financial markets, Motilal Oswal Asset Management Co. is gearing up to leverage the country’s boundless zeal for discretionary spending, coupled with governmental initiatives aimed at bolstering manufacturing capabilities. This confluence of circumstances is poised to ignite a fresh surge in shares connected to consumer-centric industries.

Niket Shah, the astute Chief Investment Officer, is strategically amplifying investments in companies that provide lower-priced luxuries—think jewelry and fashionable apparel—predicting an uptick in consumer expenditure amidst a backdrop of rising incomes. Furthermore, he is keenly exploring the promising realms of India’s burgeoning electronic component sector. Notably, the Motilal Oswal Midcap Fund has achieved an impressive 63% return over the past year, eclipsing its benchmark’s 33% increase and firmly establishing itself as a preeminent mutual fund in the country.

With food inflation remaining a persistent challenge, Shah anticipates the government will endeavor to enhance the disposable income of its citizens. “I foresee substantial modifications to the income tax framework aimed at benefiting consumers broadly,” he stated, managing assets exceeding $7 billion. Yet, the paradox remains: while elevating prices have dampened the allure of fast-moving consumer goods, individuals are seemingly undeterred in their pursuit of certain high-stakes purchases—such as luxury smartphones—even if it means compromising on more fundamental expenses.

Shah credits the fund’s success to his keen ability to identify pivotal shifts within sectors and to strategically exit positions. Prior to the implementation of fare hikes in the telecommunications arena, he invested in key players like Bharti Airtel Ltd., Indus Towers Ltd., and Vodafone Idea Ltd. Similarly, early bets on technology giants like Persistent Systems Ltd. and Zomato Ltd. have also cemented substantial gains.

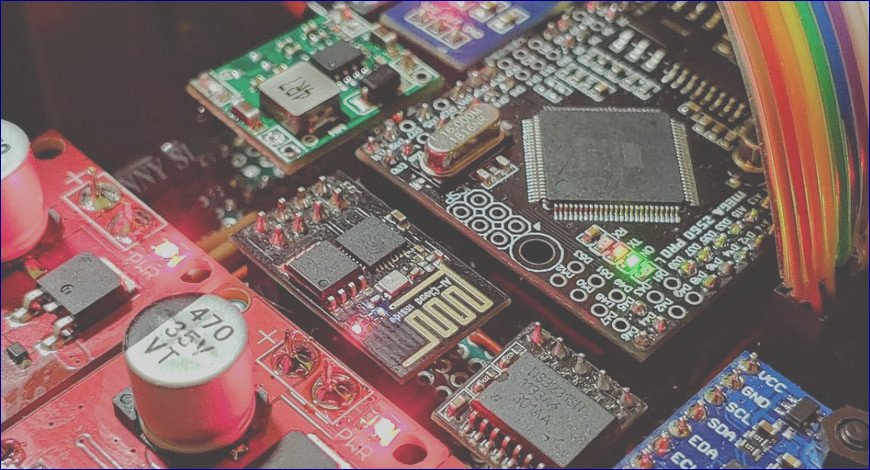

Turning to the electronics manufacturing domain, Shah maintains that production-linked incentives are set to invigorate the sector as India elaborates its role in global supply networks. “I’m beginning to sense that the government is gradually opening doors for certain Chinese enterprises to form joint ventures here,” he noted. “Marrying Chinese technology with Indian manufacturing capabilities presents an unprecedented opportunity for vast scalability.”

As of the end of November, Motilal Oswal had investments in entities such as Kalyan Jewellers India Ltd. and Trent Ltd., a budget fashion retailer. Additionally, the asset manager holds stakes in Dixon Technologies India Ltd., a contract manufacturer for the renowned Samsung Electronics Co., reflecting a diversified yet focused investment strategy poised for future growth.