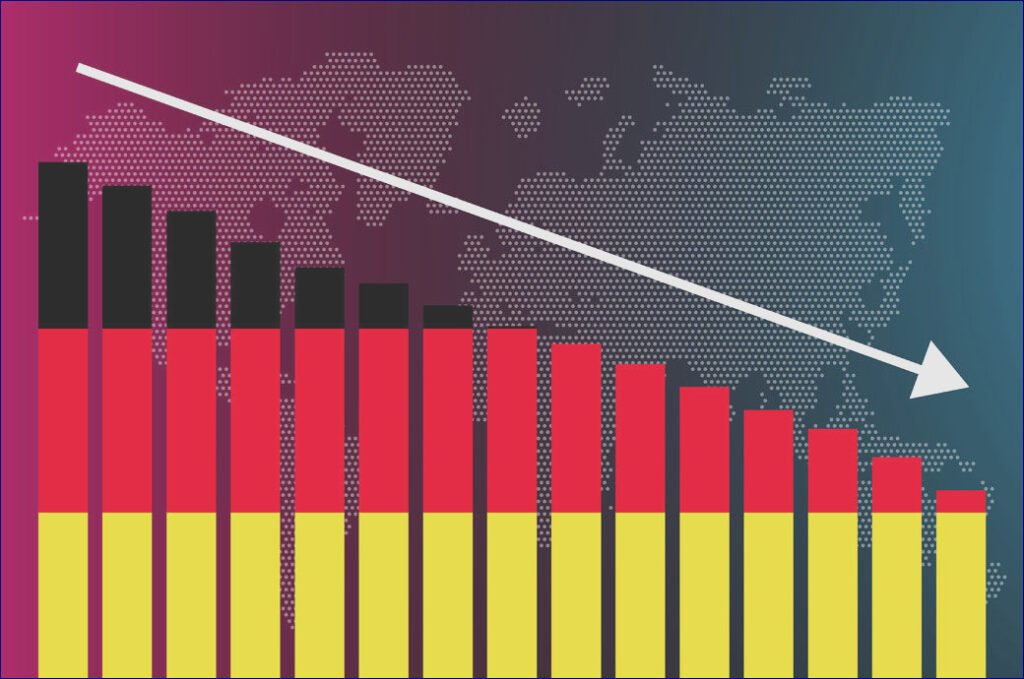

In a striking declaration that reverberates through the corridors of power in Berlin, Martin Wansleben, the astute chief executive of the German Chamber of Industry and Commerce (DIHK), recently sounded the alarm about a multifaceted crisis afflicting the German economy. His remarks came as the chamber unveiled its Fall 2024 Economic Survey, a sobering reflection of the nation’s economic malaise.

Wansleben’s commentary was unambiguous: “Germany is not merely caught in a cyclical downturn but is grappling with a persistent structural crisis.” His words paint a disheartening picture—one where investment remains alarmingly low, bureaucratic hurdles abound, and location costs spiral unfettered. “We’re losing our footing not just regionally within Europe, but on the global stage,” he lamented.

The survey’s findings are stark; a mere 19% of industrial companies consider their current circumstances as ‘good,’ while a staggering 35% characterize them as ‘bad.’ The specter of uncertain economic policies looms large, alongside soaring labour costs, acute shortages, and volatile energy and raw material prices, which have emerged as formidable threats to business viability.

Referencing the latest forecast from the International Monetary Fund, Wansleben pointed out a grim statistic—Germany now ranks a dismal 39th out of 41 advanced economies when it comes to growth. “The outlook for 2025 is even bleaker,” he continued, indicating that responses from approximately 25,000 enterprises across various sectors declined to evoke any faith in potential recovery.

“Our revised forecast for 2024 has been adjusted to a disheartening ‘zero growth,’ mirroring our predictions for the subsequent year,” he emphasized, warning that it signals the potential for a third consecutive year devoid of tangible GDP growth.

The realities of early summer pessimism have crystallized into a daunting business reality. As Wansleben noted, expectations have dimmed further, buoyed by no hopes of revitalizing economic conditions or transformative policy measures—like substantial reductions in energy prices or meaningful increases in income. “We are becoming a weight that slows down Europe’s economic momentum,” he remarked.

Delving deeper into the structural malaise, Wansleben identified an array of compounding issues: inflated energy and personnel costs, bureaucratic exhaustion, and daunting tax burdens, all intensified by geopolitical unpredictability and dwindling domestic and international demand.

The survey further revealed a disquieting trend: the proportion of companies labeling their business environment as ‘good’ has dwindled to 26%, a slight drop from 28% earlier this summer. Conversely, those calling it ‘bad’ have risen to 25%, from 23%. The industrial sector is particularly beleaguered, where optimism is nearly extinguished—only 19% of firms regard their current status positively, while 35% brand it negatively.

“We haven’t seen such dire conditions since the early 2000s,” Wansleben warned, likening the current crisis to the tumultuous period of 2002 and 2003 that prompted governmental reforms. “What we require now are profound, systemic reforms.”

Looking ahead, the forecast harbors little promise. A troubling 31% of firms predict deteriorating conditions, up from 26%, while only a meager 13% foresee improvements—down from 16%.

“For businesses, the horizon is shrouded in darkness,” remarked Wansleben.

While the recent decision by the European Central Bank to cut rates could potentially offer a flicker of hope, its effects remain elusive in the current data. Investment in fixed assets has plummeted, remaining significantly lower than pre-COVID levels, with one-third of companies now poised to scale back domestic investment—40% within the industrial sphere.

Significantly, though large-scale layoffs have not yet materialized, the era of declining or stable unemployment rates appears to be concluding. A troubling 25% of firms are prepared to downsize, while a mere 10% anticipate new hires.

As manufacturers articulate their angst, geopolitical anxieties persist, amplifying concerns about the very conditions that keep businesses anchored. A staggering 57% highlight unpredictable economic policies; 54% cite rising labour costs, and 51% lament labour shortages as significant threats. Nearly half, 49%, continue to fret over energy and raw material prices, despite recent decreases.

The erosion of competitive advantage for German firms in global markets poses a looming threat—Germany stands at risk of relinquishing its hard-won status in international commerce. Despite the global economy’s robust expansion, the export sector foresees tough times ahead: only one in five companies anticipates a rise in exports, while nearly one-third expects a downturn.

The linkage once thriving between solid global growth and the bolstering of German exports—a vital artery for the national economy—fades amidst growing concerns. The unanswered questions of Germany’s economic future hang heavy in the air, as businesses and policy-makers alike grapple with an uncertain path forward.