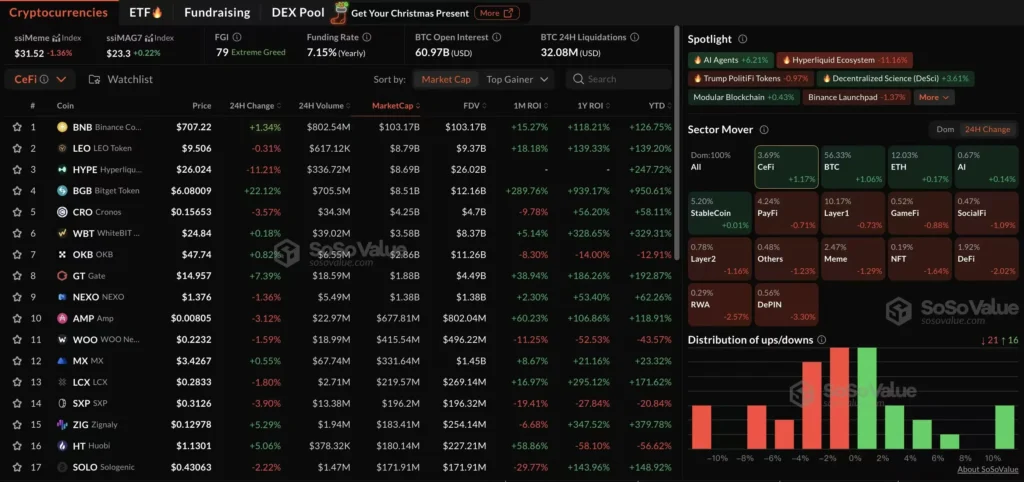

In a landscape where volatility reigns supreme, the cryptocurrency market has taken a frail step back following two days of fervent ascension. Insights from SoSoValue unveil that while the overall crypto environment experiences a modest retreat, certain sectors, notably CeFi, AI Agents, and DeSci, forge ahead defiantly, defying the prevailing trend.

Delving into the CeFi sector, a rejuvenating 24-hour surge of 1.17% unfolded, with decentralized exchange-related tokens soaring remarkably. The Bitget Token (BGB) surged an impressive 22.12%, while Gate (GT) and Huobi (HT) followed suit with commendable increases of 7.39% and 5.06% respectively. Yet, it wasn’t all smooth sailing; Hyperliquid (HYPE) confronted a stark contraction, plummeting by a significant 11.21% over the same period.

The AI Agents sphere witnessed a vigorous revival, boasting a robust 24-hour boost of 6.21%. Here, the AI Rig Complex (ARC) emerged as a front-runner, escalating dramatically by 56.55%. Not far behind, Shoggoth (SHOGGOTH) achieved a stellar climb of 44.80%, while Zerebro (ZEREBRO) also enjoyed a respectable uptick of 18.03%. Tokens within the Virtuals Protocol ecosystem rebounded gallantly after a preceding decline, with increases of 9.72% for VIRTUAL, 34.45% for GAME, and 16.59% for AIXBT capturing attention.

Meanwhile, the DeSci realm experienced a 3.61% uplift, perhaps buoyed by speculation surrounding an imminent airdrop commitment from Pump Science. Noteworthy gains were made by Urolithin A (URO) and Rifampicin (RIF), with remarkable rises of 40.55% and 26.28% respectively.

Conversely, not all sectors basked in the glow of green. The Layer 1 sector dipped by -0.73%, accompanied by slight retreats in the Layer 2 (-1.16%), Meme (-1.29%), and DeFi (-2.02%) domains. The DePIN sector bore the heaviest burden, registering a significant pullback of -3.30%.

As this vibrant tapestry of market movements unfurls, ChainCatcher urges its readers to adopt a rational lens towards blockchain technologies. Heightened awareness of risks is paramount, especially amidst the flurry of virtual token speculations and offerings that abound. It’s essential to remember that the information disseminated here is strictly for market analysis or opinion and should not be interpreted as investment advice. If any sensitive matters arise, please don’t hesitate to report them, and we will address them swiftly.