In a nuanced endeavor to navigate the swirling tides of economic uncertainty, Chinese leadership is poised to establish a growth target hovering around 5% for the forthcoming year. This ambitious goal pairs with a proposed adjustment to escalate the budget deficit to a notable 4% of the nation’s gross domestic product, as reported by Reuters through unnamed sources.

This announcement follows closely on the heels of a significant economic conference in Beijing, where paramount leaders, including President Xi Jinping, have deliberated over strategies and aspirations leading up to 2025. Nevertheless, the precise benchmarks are likely to emerge officially during the parliamentary session slated for March, adhering to the customary timeline.

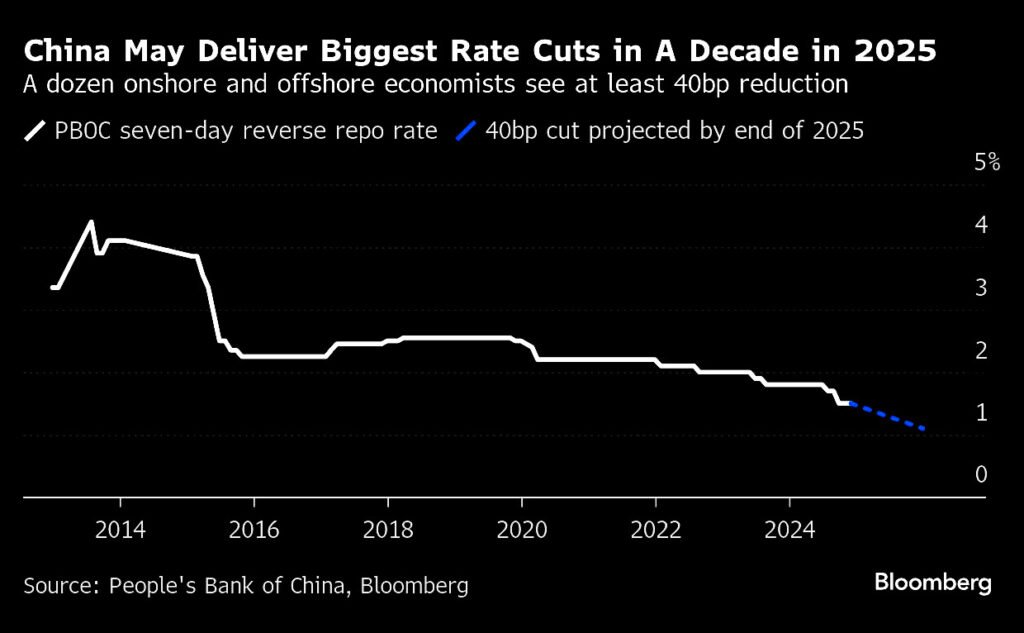

The prospective growth target resonates with the current year’s ambitious pursuit, which has seen officials launching an array of stimulus measures since September—an economic arsenal that includes rate reductions and increased liquidity for banks. Notably, these aspirations align well with the forecasted expectations of economists, who have been anticipating a strategic pivot towards enhanced government spending and robust policy support for the economy.

Market reactions, however, have been somewhat tepid amid this economic discourse. With the yuan remaining relatively steady at approximately 7.29 in both domestic and international exchanges, the yield on decade-long bonds is languishing near historic lows. Meanwhile, the CSI 300 equity index displayed a modulated range of activity, clinging to the slight uptick it had achieved prior to the midday pause.

Last week, policymakers reiterated their commitment to “stable economic growth,” signaling a focus on invigorating domestic consumption and investment during the economic work conference. Just days earlier, the 24-member Politburo had committed to a “moderately loose” monetary policy—a shift in tone not witnessed for nearly a decade and a half. This newfound responsiveness has intensified expectations of a forthcoming budget augmentation.

This strategic shift emerges against the backdrop of potential tariffs looming on the horizon, as the world braces for a tumultuous trade relationship with the United States under the impending leadership of Donald Trump. Should tariffs rise, the repercussions could stymie China’s export-driven growth—a pillar that has undergirded nearly a quarter of this year’s economic ascent.

Setting the budget deficit at 4% symbolizes a departure from the traditional constraint of 3%, signaling a bolder stance on fiscal stimulus. However, this increment—while noteworthy—might still fall short of adequately bridging the widening chasm in domestic demand, potentially leaving the specter of deflation unaddressed.

Furthermore, top officials have pledged to amplify the issuance of special treasury bonds alongside local government bonds to catalyze growth. These instruments, historically integral to infrastructure funding, are now being strategically deployed in broader arenas, including subsidies for consumer spending.

Meanwhile, the economic landscape remains uneven. November data revealed a puzzling deceleration in retail sales growth, juxtaposed with resilient industrial production figures. An overarching cloud of uncertainty continues to loom, stalling consumer confidence amid a beleaguered property market and a somber labor environment. The internal economy teeters, balancing on the precipice of both opportunity and challenge.