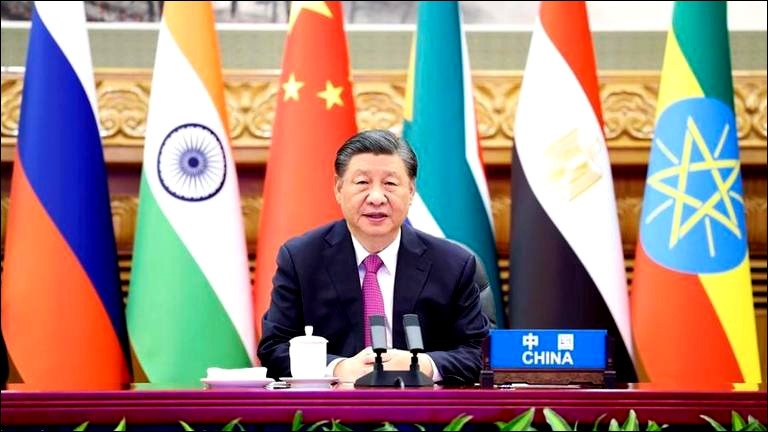

As the stage was set for the 2024 BRICS summit, President Xi Jinping of China stood tall, proclaiming his nation’s advancements in Green Technology as not just a beacon of hope for the bloc but a “valuable reference” for the entire globe. Yet, amidst these grand declarations about renewable energy as a catalyst for economic rejuvenation, the sobering truth of a faltering Chinese economy looms large—a paradox that cannot be overlooked.

October heralded the revered Golden Week, a time typically bursting with jubilant celebrations of national pride, yet this year, the air was thick with a notable sense of restraint. The 75th anniversary of the Chinese Communist Party’s ascension to power came and went under a shroud of muted acknowledgment. The once-bustling streets saw fewer revelers, a stark contrast to historical precedents, as a tide of economic unease washed over the nation. Despite stimulus measures from the Central Committee, chaos reigned as China grappled with undeniable economic stagnation.

Promised financial succor materialized in various forms—trims to existing mortgage rates, hefty capital injections into colossal banks that hadn’t seen such measures in a decade, and innovative approaches to foster mergers and acquisitions. Yet, as the days of Golden Week rolled on, the anticipated consumer exuberance failed to flourish. Erratic economic signals raised more questions than answers, unsettling investors whose nerves frayed under the weight of vaguely articulated stimulus measures devoid of substantial backing.

Chinese state media presented a curated narrative of progress; however, the stark realities of crumbling birthrates and mounting economic tribulations were conveniently obfuscated. The intent was clear: bolster consumer sentiment, instill faith, and ignite a spark of hope amid the potential for a rising tide of spending. Alas, as the festivities unfolded, the questions surrounding China’s economic strategy and long-term prospects became increasingly pressing. The fix? A leap into the future of manufacturing and high-tech innovation, particularly green technology.

Yet, the dance is fraught with risk. China, despite facing tariffs imposed by Western powers on its electric vehicles, remains steadfast in its ambition to dominate the green energy landscape. This commitment reverberates through Xi Jinping’s speeches, where he highlights his nation’s breakthroughs, painting China as an indispensable player in the green economy of tomorrow.

As the government shifts its focus to rejuvenating green tech exports, it champions the “new three” industries—solar cells, lithium batteries, and electric vehicles—while rapidly accelerating advancements in hydrogen technology for commercial vehicles. This pivot is combined with a framework of party-controlled financial oversight, raising eyebrows among skeptics who question whether such oversight can genuinely nurture environmental sustainability.

With the establishment of the Central Financial Commission, a transfer of financial authority from quasi-independent institutions to the hands of the Party signifies a robust intent to steer export policies towards environmentally friendly initiatives. However, the efficacy of such endeavors remains in the balance, particularly as external tariffs threaten to impede ambitious export plans at a time when China stands at a crossroads with over-investment in manufacturing.

The ambitious green revolution carries a whiff of speculation, teetering ominously on the brink of a potential collapse. Implemented amid these grand aspirations is the recently launched China Certified Emission Reduction scheme, designed to facilitate trading of carbon credits. While such systems could promise economic flexibility, apprehensions are palpable among traditional pollution-heavy industries and hydrocarbon producers feeling the tremors of the governmental shift toward stringent emissions controls.

Amidst these maneuvers, China’s energy security remains sacrosanct. The constraints imposed by global energy price shocks, exacerbated by geopolitical strife, led President Xi to reaffirm a pragmatic reliance on fossil fuels. Coal mining operations, contrary to being set aside for greener pastures, are set for expansion, signaling a duality in strategy: green energy primarily for export, and domestic needs catered to through traditional energy sources.

As China’s economy grapples with significant struggles, its forward-looking ambitions in the global energy arena continue unabated. The drive to be the premier supplier of green technology sits oddly juxtaposed against the backdrop of its domestic economic challenges. Eyes are on Beijing as it banks heavily on the hope that by establishing itself as the frontrunner in global green tech, it can stave off economic freefall and emerge not merely as a participant but as a leader in a transformed energy landscape. A bold gamble, indeed, with the world watching closely.