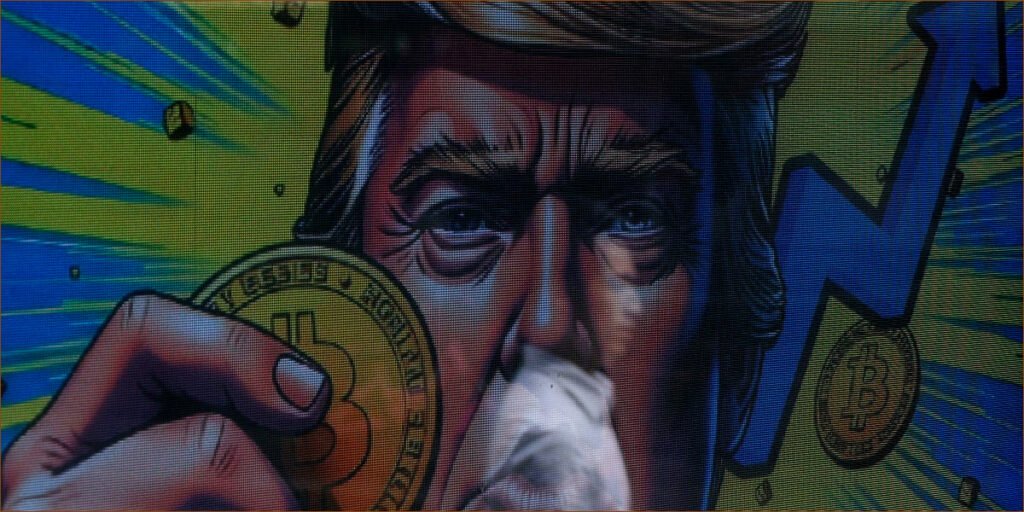

In a ripple that has sent shockwaves through the cryptocurrency ecosystem, Bitcoin’s value plummeted following a controversial announcement from former President Donald Trump regarding a proposed strategic bitcoin reserve. This revelation ignited a wave of skepticism and disappointment among traders and investors alike.

On the crisp morning of Monday, amidst an already turbulent market, Bitcoin experienced a downturn of approximately 1.5%, landing at just above $83,000. This drop isn’t an isolated incident; since Thursday, the leading cryptocurrency has shed over 8% of its value, leaving many in the community reeling. Ethereum didn’t fare much better, suffering a decline of about 5.5%, while XRP faced its own struggles, decreasing by 2.5% and suffering a staggering 12% dip over the past week.

The crux of the matter lies in the details of Trump’s executive order, which clearly delineated the strategic reserve’s composition. The order specified that the reserve would solely encompass Bitcoin already under the government’s auspices, primarily acquired through asset seizures linked to criminal and civil actions. This sparked rampant speculation around the potential for fresh Bitcoin purchases to augment the reserve—speculation that now seems dimly lit.

Critics have voiced their discontent over the government’s decision to allocate lesser-known cryptocurrencies into a separate fund, raising eyebrows over the implications for those digital assets. Many insiders had envisioned a robust collection of Bitcoin, which might have solidified the U.S.’s stance in the crypto arena, previously touted by Trump as positioning the nation to become the “Crypto Capital of the World.”

However, the narrative now shifts toward a more conservative outlook. In the executive order, it was inscribed that the U.S. Treasury and Commerce secretaries must craft plans to acquire additional Bitcoin holdings—contingent on those plans being budget-neutral. This suggests a carefully calculated approach, avoiding any financial burden on American taxpayers. David Sacks, dubbed the administration’s “crypto czar,” took to social media to assure the public that utilizing existing government-held Bitcoin would mean that taxpayers wouldn’t bear the cost of this endeavor. He clarified that the treasury would not pursue further assets outside of what was secured through forfeiture processes.

In a bid to maintain transparency, Sacks has also initiated an audit of the government’s cryptocurrency reserves. Estimates suggest that the U.S. currently owns around 200,000 Bitcoin, a staggering asset amounting to nearly $16.5 billion. The journey forward for cryptocurrencies remains clouded in uncertainty, as market players assess the ramifications of this recent announcement, grappling with the ever-evolving complexities of the digital finance landscape.