In the intricate realm of professional sports, the NFL reigns supreme, a titan among leagues, standing apart from the NBA and MLB with its unique operating model. Here, it’s not just the local media rights that drive revenue; instead, the NFL has perfected the art of national revenue streams, proving their efficacy time and time again.

Streaming technology has crashed through the gates of traditional sports broadcasting, reshaping how fans engage and watch their favorite teams. This seismic shift presents a clarion call for other major U.S. leagues to rethink their approaches. What if they, too, embraced a national revenue model enhanced by the streaming wave? Could this unlock new realms of triumph and fan interaction? The concept of revenue sharing—an NFL hallmark—could very well hold the key to elevating team values across the board. So, will other leagues follow the NFL’s lead, or will they carve their independent paths to success?

The Business Landscape of Professional Sports

Professional sports operate under a distinct framework—each league exists as a collection of individually owned teams, adhering to specific rules defined by collective bargaining agreements (CBAs). The NFL towers above its counterparts in terms of viewership and revenue, yet its revenue is divided into two primary streams: national and local. Unlike the NBA, MLB, or NHL, the NFL places monumental emphasis on national revenue. Here, all teams share national revenues equally, while local revenues remain under the control of individual franchises. This configuration entails that national revenues primarily derive from media rights reaching a vast audience, while local revenues arise from ticket sales, concessions, and localized media rights tied to specific markets.

Dissecting League Structures and Strategies

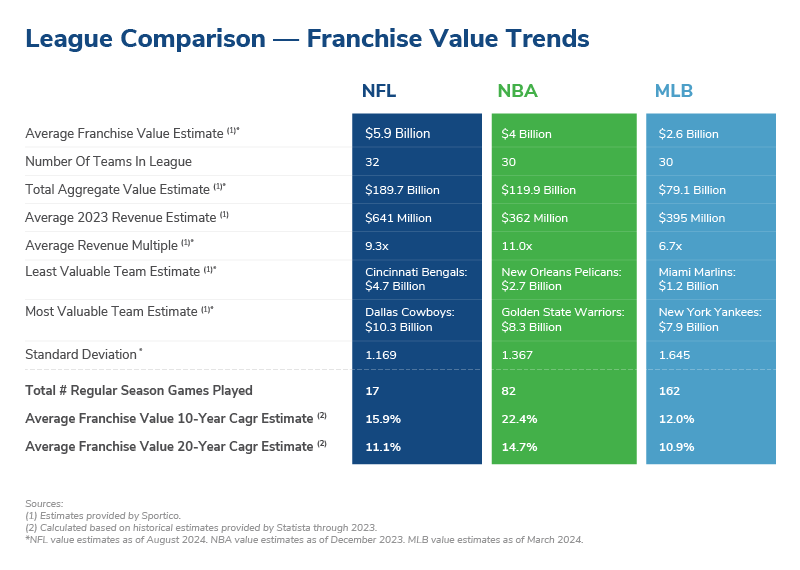

The fundamental structures of these leagues differ immensely, with their CBAs reflecting their unique operational philosophies. Points such as salary structures, free agency, and playoff formats vary widely. For instance, NFL teams engage in a mere 17-game season, contrasting sharply with the MLB’s expansive 162-game schedule. Additionally, the NFL employs a hard salary cap, setting it apart from many other major leagues. These inherent characteristics critically shape the revenue streams and income potential for franchises within each league.

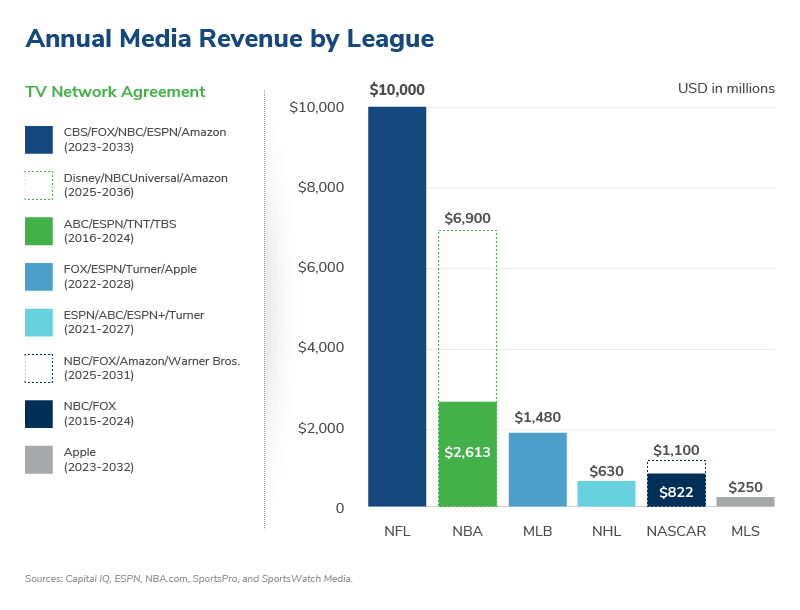

The NFL capitalizes on the principle of scarcity, with its limited number of games driving demand sky-high. This scarcity empowers the NFL to focus intensely on the national market. Each week’s limited inventory allows NFL games to dominate major broadcasting networks, drawing in millions nationwide and translating into staggering revenue—which shared among teams—totals billions annually. Case in point: an 11-year media rights deal worth over $110 billion was recently struck. In fact, according to SportsMediaWatch.com, every single one of the 56 most-watched sporting events in 2023 was an NFL game, with 96 out of the 100 top TV broadcasts also featuring the NFL. A noticeable leap from 82 in 2022.

Turn your gaze to Major League Baseball. In 2022, the MLB renewed its national media contracts, amounting to an impressive $12.6 billion across seven years, with individual teams independently negotiating local broadcast contracts. Here, local revenue plays a crucial role, with team valuations deeply intertwined with the size of their respective markets. In stark contrast, NFL teams experience less variance in annual revenue due to their revenue-sharing model, which mitigates the disparities seen in local-focused leagues.

Similarly, the NBA operates with significant local revenue streams—but its national contract revenue is surging, reflecting an ever-increasing popularity. A newly renegotiated media rights deal, set to begin in 2025, boasts licensing fees tripling previous amounts, totaling nearly $75 billion over 11 years.

The divergent operational frameworks of the NFL, MLB, and NBA create a striking contrast in their ability to generate value. With a national focus, the NFL promotes financial equality, while the MLB and NBA cling more tightly to local revenue models that can foster discrepancies in team valuations.

Insights into Team Performance and Valuation

A narrative of transformation unfolds in 2023 as the Detroit Lions aim for NFL championship glory after a long drought of underperformance. Emerging from decades in the shadows, the Lions, led by the impassioned coach Dan Campbell, have reignited their fanbase, resulting in ripples across ticket sales and sponsorship revenues. In stark contrast, the New England Patriots find themselves grappling with declining fortunes, enduring a lackluster season and parting ways with legendary coach Bill Belichick. As they navigate the post-Tom Brady landscape, the question lingers: Can they uphold their revenue levels in a new era of uncertainty?

Playoff revenue remains an unpredictable beast, impacted by teams’ ability to qualify. With only eight home games each season, stadium revenues across franchises remain relatively stable, while sponsorship earnings, bolstered by national deals and local relationships, find their strength tempered by revenue-sharing practices. The Dallas Cowboys, the league’s crown jewel in terms of valuation, adeptly secure the largest share of sponsorship income in the NFL.

The NFL’s Winning Formula

What is the essence of the NFL’s success? Could it be the reduced number of games fueling a high-stakes environment? The league’s strategy revolves around competitive balance, national promotion, and equitable revenue sharing, creating a model that not only enhances fan engagement but also drives unparalleled financial success.

The economic dynamics of supply and demand underpin the divergent values and strategies adopted by each league. The NFL commands premium pricing for its media rights, akin to luxury brands that limit availability to ignite demand and elevate pricing.

Even college football is mirroring the NFL’s approach, consolidating into powerful conferences capable of securing lucrative broadcast agreements to attract expansive national audiences.

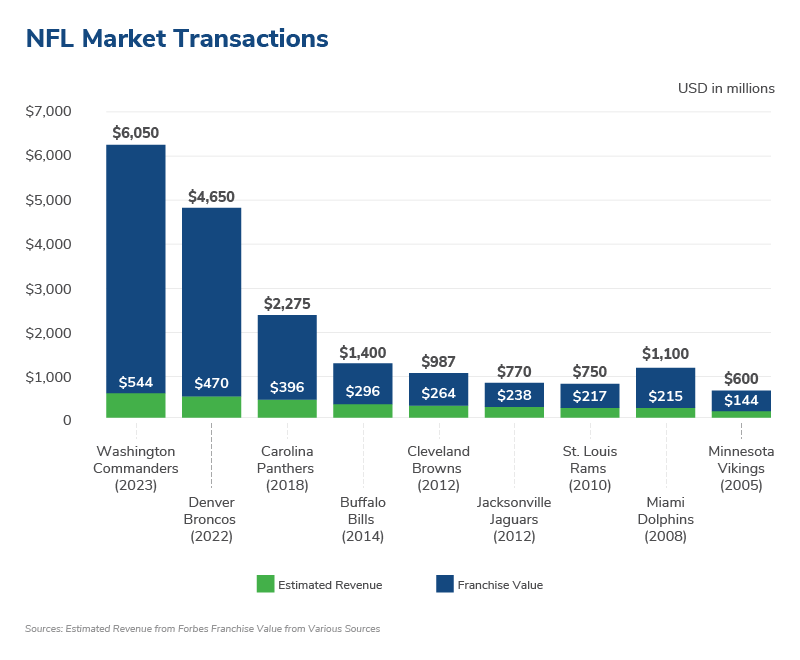

Franchise values have skyrocketed over the past two decades alongside escalating media revenues, exemplified by the historic $6.05 billion sale of the Washington Commanders, marking a pinnacle transaction in sports team history.

Yet, the NBA is closing in. In the aftermath of a successful championship run and a newly minted media deal, whispers suggest that the storied Boston Celtics may be on the market, potentially commanding a valuation exceeding $6 billion.

The Road Ahead: Embracing Streaming

Could other leagues—such as the NBA, MLB, and NHL—mirror the NFL’s success by pivoting towards a more nationally-centric strategy? The evolution of streaming distribution may hold the answer. Notably, the NBA is witnessing its national media revenues outpace local gains—a shift fueled by a decline in traditional linear television and the struggles of regional sports networks. Diamond Sports recently entered bankruptcy but announced a strategic partnership with Amazon to amplify game distribution. The question remains: will these leagues adopt revenue-sharing structures akin to the NFL’s?

The advent of streaming is ushering in a new era. For example, Peacock’s innovative approach to stream the January 14, 2024, playoff game between the Kansas City Chiefs and Miami Dolphins garnered immense viewership, contributing nearly three million new subscribers—a testament to the potential of this distribution model.

Amazon has also made a bold move into sports streaming as a key partner of the NBA’s new deal, investing $1.8 billion annually for select game rights.

Major League Soccer epitomizes this streaming shift, having forged an exclusive media pact with Apple that revolutionizes how fans access matches, thereby sidelining traditional broadcast forms.

Bigger still, a consortium of Fox Corp., ESPN, and Warner Bros. Discovery is reportedly developing a joint streaming platform named Venu Sports, set to reshape the sports streaming landscape, though embroiled in legal challenges that cast uncertainty on its future.

Navigating the Future Landscape

Despite the legacy hurdles and structural variances, leagues looking to break away from the NFL’s shadow must seize the revenue possibilities inherent in their local markets while leveraging streaming technologies to engage broader audiences.

Equipped with the technological prowess of streaming, a national-focused media strategy emerges for all sports leagues, unlocking the potential for elevated revenues and enriched franchise values. In this sprawling landscape, the dance of competition continues, and only the most agile will thrive.