Investing in MicroStrategy (MSTR) may evoke a sense of excitement, especially when its stock price seemingly soars. Yet, for investors who value fundamental integrity and sustainability, this may not be the time to dive in. With the company on the brink of announcing its Q3 earnings, my stance on MSTR remains decidedly neutral, a cautious stance bolstered by a less-than-stellar recent performance record and an alarmingly inflated valuation.

At the helm of this enterprise analytics and mobility software firm is the indefatigable Michael Saylor, a polarizing figure who is as celebrated for his unabashed Bitcoin advocacy as he is criticized for aggressive investments therein. Indeed, MicroStrategy is known more for its Bitcoin accumulation than its software solutions, with Saylor leading the charge in staunchly supporting the cryptocurrency and its underlying blockchain technology.

In a paradox of ambition, MicroStrategy has leveraged significant capital to fund its Bitcoin purchases, frequently incurring substantial debt to bolster its portfolio. In my prior observations, I have voiced concern over the extreme nature of their Bitcoin acquisitions. Today, however, I’ll delve into various metrics that suggest MSTR stock might be reaching unsustainable heights.

Proceed with Caution Regarding MicroStrategy Stock

While price appreciation and valuation are distinct entities, the trajectory of a stock’s price cannot be ignored. Remarkably, MicroStrategy’s share price has shot up by more than 450% within the past year. This significant surge prompts a crucial query for prudent investors: is the risk-reward dynamic still advantageous following such a dramatic rise? Profitable exits are, after all, a wise strategy post-massive gains.

Although cryptocurrencies are notorious for their volatility, the current peak of Bitcoin at around $68,000 warrants a moment of reflection. Given MicroStrategy’s reliance on Bitcoin for leveraged price movements, a discerning approach is essential, especially lacking the security that comes with established blue-chip stocks.

Moreover, one cannot overlook Saylor’s audacious prediction that Bitcoin might skyrocket to an astounding $13 million by 2045, indicating an almost surreal 20,000% growth from today’s values. Such forecasts, while captivating, should be regarded with skepticism; financial decisions should not hinge on speculative visions, especially those set over two decades in the future.

Concerns Over MicroStrategy’s Valuation

Recently, Peter Schiff of SchiffGold.org declared on X that MSTR is potentially “the most overvalued stock in the MSCI World Index,” warning of an impending catastrophic decline. While this statement might swing between hyperbole and caution, it underscores a significant concern: MicroStrategy operates at a loss and boasts no price-to-earnings ratio (P/E). Nevertheless, other valuation metrics paint a concerning picture.

MicroStrategy’s trailing 12-month (TTM) price-to-sales (P/S) ratio stands at an astonishing 81.31x compared to a mere 3x median for its sector. Its TTMP/B ratio is similarly disconcerting at 15.87x against a sector median of 3.33x. While I shy away from labeling MSTR the “most overvalued,” for those focused on value, a neutral outlook on MicroStrategy appears prudent.

An Earnings Report on the Horizon

If you’re a die-hard cryptocurrency enthusiast contemplating a MicroStrategy investment, I advise postponing your decision until month’s end. The company is set to unveil its third-quarter 2024 earnings report on October 30, an event that could significantly alter the investment landscape.

Analysts project a loss of $0.12 per share for this quarter, a forecast I approach with skepticism given MicroStrategy’s history—of the last four earnings announcements, the company missed expectations thrice.

After the upcoming report, you’ll gain crucial insight into MicroStrategy’s financial trajectory. Will it continue to post losses, or might it surprise investors with profitability? Why engage in speculation when newer data is imminent?

Is MicroStrategy Stock Worth It?

On the TipRanks platform, MSTR is classified as a Strong Buy, buoyed by five unanimous recommendations from analysts over the past three months. The average price target for MicroStrategy stands at $229.60, indicating a slight potential downside of 2.02%.

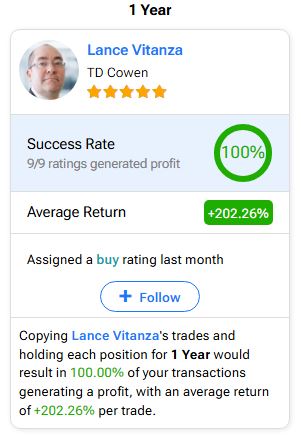

For those deliberating over MSTR stock transactions, consider following the insights of Lance Vitanza of TD Cowen, whose record boasts an impressive 202.26% average return per rating and a perfect success rate over the last year. His analyses might offer valuable guidance amidst the current uncertainties.

Final Thoughts: Should You Invest in MicroStrategy?

Will Saylor’s daring Bitcoin price predictions unfold into reality? Can MicroStrategy defy Wall Street’s earnings projections for this quarter? Making confident investment decisions amidst such ambiguity is challenging.

The legitimate apprehensions surrounding MicroStrategy’s valuation should not be overlooked by discerning investors. Thus, while I advocate for the broader pro-Bitcoin narrative, I find it prudent to adopt a watchful position regarding MSTR at this juncture.